Álex Pardillos Boada, Consultant at Altria Corpo

Companies find it very difficult to obtain financing, and this is not always due to a lack of alternatives, but rather to a lack of knowledge about them. This article describes the different causes of not obtaining financing and how we can solve this problem.

Today, we find ourselves in an unpredictable and uncertain economic and financial context. Between inflation, wars, rising interest rates, poor economic forecasts, concentration of financial institutions, refinancing and an increase in insolvency proceedings, the panorama ahead of us forces us to pay special attention to the financial situation of companies.

Due to my work as a financial consultant to companies and my previous experience in banking, I have seen over the years that many companies find themselves stranded every time they try to access financing. I could name countless occasions in which these companies have not been able to obtain the financing they needed at the time they really needed to meet their short-term obligations or to undertake investments, causing situations such as non-payment to suppliers, not being able to respond to the demand of their customers or not paying the salaries of their workers, when they were not forced to go into bankruptcy. This situation creates different problems and conflicts at different levels of the economy and, worse still, has repercussions in our homes and in our daily economy.

As a result, when it comes to company financing, anyone, be they financial consultants, intermediaries, or even company directors and managers of the different financing entities, are having serious problems in obtaining approval for operations that help companies to grow and be able to overcome any type of adversity that may occur.

Today, we have a large number of financial institutions, both banks and alternative financiers, which may give the impression that between them all they can respond to the financing solutions that the market demands, but unfortunately this is not the case. A large number of these financial providers are not known to companies, so it makes sense for companies to turn to financial consultants or intermediaries to try to obtain financing in any way possible, both by reformulating the application to providers with which the company has already tried without luck, and above all by giving access to new entities with which the company had no contact or was simply unaware of.

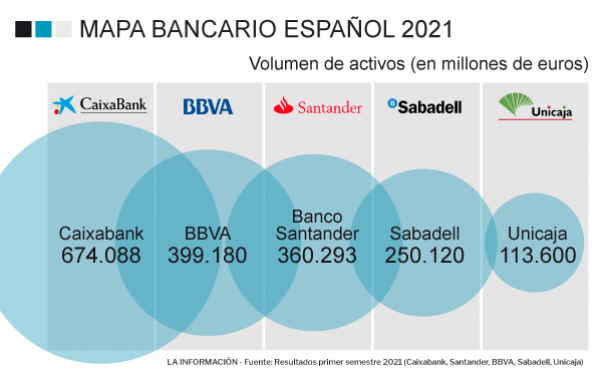

One phenomenon that has contributed to the difficulty of access to credit has been the concentration of banking institutions, brought about by various factors such as the pressure exerted by the policies of the European Central Bank itself. Alternative financing institutions have entered the scene and have taken advantage of this to grab a piece of the cake left by the traditional banks. However, there is still a long way to go before the full volume and type of financing operations demanded by the market can be met.

The main problems to be addressed are basically four:

- Delays with operations: financing operations must be resolved in a short period of time; they cannot be extended by weeks or months due to delays in providing a response from financial institutions or, on the contrary, due to poor management by SME financial managers when it comes to providing transparent and correct documentation.

- Restrictive risk policies: many institutions’ risk policies include too many barriers, requirements, conditions and guarantees when granting financing.

- Analysis of only historical economic and financial information: the usual analysis carried out by financial institutions on a financing operation is based on a review of the company’s historical information. This information is necessary but not sufficient for a complete analysis, as it does not take into account either the present or the future. This happens when reviewing, in the current year, last year’s corporate income tax as the only reliable source, when several months have already passed and the company’s financial picture may have changed significantly for the worse or for the better. Balance sheets and interim income statements for the current year are always taken as a guideline and are only useful in the rare case that they reveal a worsening of the financial situation, never an improvement. In short, the official documentation to really know what the company is earning and what the financial situation is at the precise moment the credit is requested is minimal, and one can only resort to bank statements and the Cirbe risk sheet of the Bank of Spain.

Often, to support the company’s plans for the future, the company presents business plans that are not very credible, without any professional review and without substantiated projections to make an estimate of what they can earn in the coming months and years. In such estimates, there are dynamic methods to get an idea of the company’s image in the near future, but without solid assumptions and professional work, it is a dead letter for the financial institution that studies it.

- Financial solutions on the market: there is a large number and diversity of active financial providers, but each one focuses on a specific financial solution, so that most of the time the solutions provided by them cannot respond to all types of operations and clients.

How can each of these problems be solved?

1. Delays in operations can be solved in a simpler way than it seems. Financial reporting should be done in a professional manner, explaining in detail how the companies operate, their business model, where they come from and what their current and future strategy is. In this role, CFOs and CEOs have to be 100% open with their financial providers and provide all the information required from the outset. In this way, with the necessary documentation and a well-prepared financial report, the work of the professionals who make up the teams of the financial institutions is greatly facilitated; the office managers will be able to integrate the documentation and send the operation to the risk department in a more agile way, which will lead the analysts of these departments to resolve more quickly whether they are positive or negative sanctions.

Hiring financial consultants will improve the drafting of this report, enrich the vision of the possible approaches to be taken and give access to a much larger number of financial providers. Many of the professionals in these financial consultancies come from banking and alternative entities, and know how to deal with a credit application, how to prepare and explain a company and its financial needs and, above all, what risk strategy each financial provider follows and the best way to proceed with each of them. Likewise, the experience and knowledge of the financial products that best fit the needs of the companies help enormously in channelling each credit application efficiently.

2. Credit institutions should constantly review their risk policies, monitor the effects of these policies and be more flexible, observing what other competitors, especially non-bank competitors, are doing.

This is particularly relevant in the case of companies that already work with a bank and have a long-standing relationship with it.

3. Financial institutions have to improve and look for a financial analysis mix of static and dynamic methods in order to be able to respond to financing in the right way and not miss out on good business opportunities.

One proposal that could be considered is to have an official document in which companies, in a similar way to the IVAS or personal income tax withholdings presented on a monthly or quarterly basis, would be obliged to present a balance sheet and an interim profit and loss account that would give a true and fair view of the company and thus help them to obtain financing.

4. Finally, referring to the solutions we have today, we could comment that there is a wide range of solutions for national and international operations. Even so, the market needs many more to satisfy all possible needs and casuistries. Amongst the proposals that we feel are lacking, we can identify the need for more mutual guarantee companies that can guarantee the operations of companies; the existence of more debt funds for SMEs that can inject sufficient money for the achievement of their corresponding long-term projects; more collaboration between financial institutions to jointly finance companies; and more specific financial solutions for companies of different sectors and sizes, which are excluded from the banking sphere but which could be financed with debt instruments without having to go directly to make rounds of capital investment to maintain their activity.

There is still a long way to go in the financial sector, we find ourselves in an economic and social context that demands more solutions in all areas, and the financial sector is vital for our economy. Difficult times lie ahead, full of opportunities to make possible what sometimes seems impossible. I encourage all professionals in the sector to reflect and seek solutions to help the self-employed, businesses, SMEs and large companies to continue to grow and improve.

Alex Pardillos Boada

Consultant Corporate Area at Altria Corpo