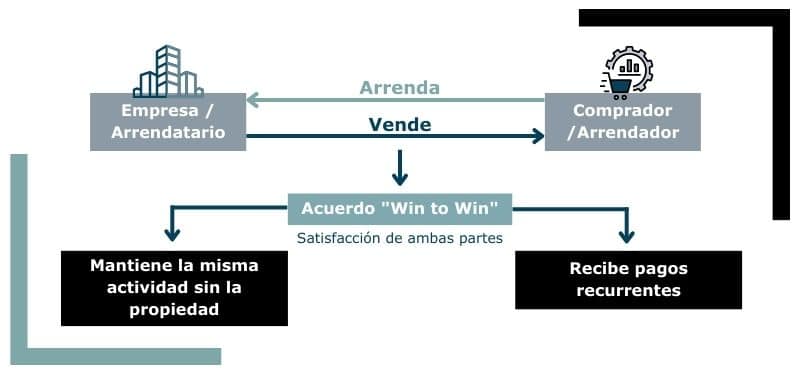

In a previous post we presented the sale and lease back as an operation that provides liquidity to the company. In this article we will assess its undoubted advantages and also some of the disadvantages it may have.

Advantages of sale and leaseback

Let us remember that the company that carries out a sale and lease back with a property it owns obtains several advantages:

– It obtains immediate liquidity derived from the fact that it receives the price of the sale of the property. This liquidity can be used to reduce existing debt or to undertake new investments.

– You can continue to occupy the property, no longer as the owner but as a tenant, so you can continue your business without having to move.

– You will have the option to repossess the property if you exercise the purchase option.

– There can be a balance sheet improvement as a fixed asset is converted into cash, which can be beneficial to the perceived financial health of the business.

Disadvantages of sale and leaseback

In addition to these advantages, there are also some disadvantages to be considered in this type of transaction:

– Long-term cost: although sale and leaseback provides immediate liquidity, it usually entails a higher long-term cost than maintaining ownership and financing the asset through other means.

– Loss of ownership and inability to benefit from future appreciation of the asset.

– The lease resulting from sale and leaseback ties the company to a long-term contract, which may limit its operational and financial flexibility. If the company’s needs change, it may find itself tied to an asset that no longer fits its operations or strategies.

– The sale and leaseback process can incur significant transaction costs, including legal fees, valuation fees and other administrative expenses. These costs should be considered when calculating the net benefit of the transaction.

In the third and final article on sale and leaseback, we will discuss the details and operation of sale and leaseback transactions.