The results of the Barometer developed by Altria Corpo and the IEF reveal a tightening in the credit market for companies and an increasing search for fintech solutions and alternative financing.

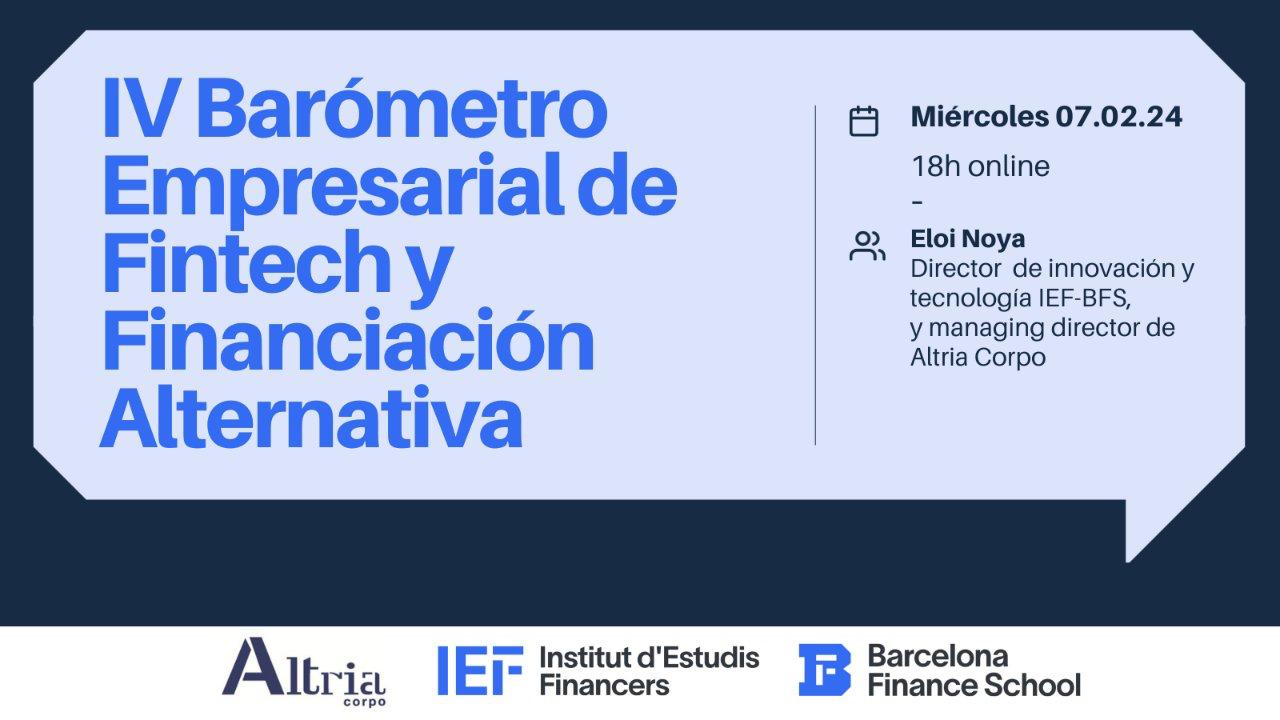

On February 7th, the results of the 4th edition of the Business Barometer of Fintech and Alternative Financing, conducted by Altria Corpo in collaboration with the prestigious Institute of Financial Studies (IEF), were published. This Barometer periodically collects the opinions, personal experience, and expectations of companies and providers of business financing (both banking and alternative) regarding credit granting policies, and especially the knowledge and use of fintech and alternative financing by companies.

In this 4th edition, whose surveys were conducted between October and December 2023, there is a notable increase in the difficulty of accessing bank credit. Up to 52% of companies believe that access to bank financing was difficult or very difficult, compared to 44% the previous year. Pessimism also continues regarding the possibility of banks mobilizing credit for 2024. 42% of companies believe that no bank will mobilize, and the banks themselves do not foresee an increase in lending: 30% believe that no bank will mobilize credit, and 70% believe that only some banks will do so.

The degree of knowledge about alternative financing among companies is consolidated around 80%, and 48% of companies have used some form of non-banking financing solution, with factoring and leasing being the most used instruments. As for fintech, a subgroup of alternative financing characterized by the use of technology and online platforms, the degree of knowledge among companies is around 50% and its use, however, is reduced to 22%, with invoice advance being the most used fintech product.

The outlook for 2024 is somewhat gloomy for companies. Banks and alternative financiers foresee continuing to raise interest rates and further tightening credit granting policies. Faced with this, the percentage of companies that need to seek financing during this year exceeds 75%, and up to 54% of companies claim they will seek alternative financing sources to cover this shortage of bank credit.

You can see the main results of the Barometer in the link:Resultados Barómetro Financiación Otoño2023

Click here to access the video presentation of the Barometer.