Direct lending is a type of corporate debt in which lenders other than banks lend to companies without intermediaries, such as an investment bank, a broker or a private equity firm.

In direct lending, borrowers are usually small or medium sized companies, rather than large listed companies, and lenders may be wealthy individuals, family offices or asset management companies.

Direct lending has found its place thanks to the reduction in volumes that traditional banks have experienced in lending to companies. The reason for this reduction can be found in the increasingly harsh regulation of corporate lending, which forces banks to provision more capital each time they grant a loan.

This has provided an opportunity for a growing group of asset managers to start lending, from which both medium-sized companies and larger corporations (through syndicated loans) have benefited. It has also benefited investors in these direct lending funds, which were looking for a response to the very low market returns in recent years.

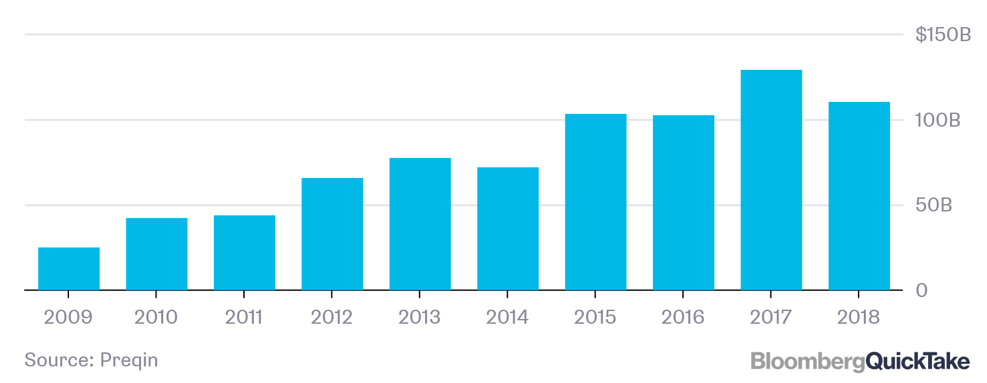

The global volumes of these private debt funds have grown steadily and now stand at over $100 billion.

Despite this boom in direct lending around the world, in Spain it is still a very unknown instrument for medium-sized companies, as are a multitude of alternative financial solutions to banking. Altria Corpo wants to help these companies, advising them on the best financing solution for each case, and giving them access to the more than 100 financial providers it currently has.